Why upgrading bitumen in Alberta no longer makes sense

Energy executives in Calgary are likely still reeling from the shock and horror of having to live with an NDP government for the next 4 years. The newly elected government has pledged to get tough on climate change and diversify Alberta's economy away from oil. Completely contrary to these commitments, they've also expressed a desire to see more upgraders built in the province and would like to stop the export of "raw bitumen" to the Americans. Although it sounds like the NDP is just throwing everything at the wall and seeing what sticks, many oil companies are getting a sick feeling of deja-vu. Yes, we've been down this path before. This most recent economic downturn seems to have brought the few remaining Alberta socialists back out of the closet.

"The PCs have squandered Alberta’s resource wealth . . . They have done this by neglecting our opportunity to invest in value-added processing and refining – investments that would create more jobs in Alberta instead of exporting them to Texas.

We’ll reduce our province’s over-dependence on raw bitumen exports and create more jobs with more upgrading and processing here, rather than in Texas."

- Alberta NDP Platform

FIRST A LITTLE HISTORY

About 10 years ago, life was really good in Edmonton's Refinery Row. Hundreds of billions worth of new upgraders were in the works. Demand for engineering, construction and tradespeople was insatiable.

But things unravelled relatively quickly. Skyrocketing capital costs and shrinking heavy oil differentials had oil companies thinking twice. Synencos's Northern Lights upgrader was the first to be shelved indefinitely, followed by Petro-Canada's decision to cancel its Fort Hills Upgrader. Statoil's mega-upgrader project failed to ever get off the ground. BA Energy's Heartland Upgrader was mothballed shortly after construction began. Shell cancelled plans to expand its Strathcona County upgrader. Suncor was the last to scrap its Voyageur Upgrader in Fort McMurray, despite having already sunk $2 billion into the project.

THE NEW REALITY

After the death-spiral of 2008, only 2 large projects remained on the books - the Fort Hills Mine, which had been put on hold, and the Kearl Oil Sands Mine, which was already in construction. Initial phases of development for both mines would see over 350,000 barrels per day (bpd) come on line by 2017. Once expanded, the two mining facilities are expected to have a combined capacity greater than 500,000 bpd.

More importantly, Kearl and Fort Hills were the first mega-mines that did not include plans for an upgrader. These facilities were intended to produce partially de-asphalted diluted bitumen, to be sold directly to heavy oil refineries on the open market. This had many in the energy patch wondering if new upgraders would ever be built in the province.

As the job market imploded in 2008/09, the Alberta government began looking for ways to stop the carnage, particularly in the Edmonton area which was hit especially hard. Rumours were abound that the province would make upgrading mandatory for approval of any new developments in the oil sands, particularly for mine operators.

Of the 8 upgraders that were supposed to be built in the province, only one survived. The Alberta government partnered with Canadian Natural Resources (CNRL) to build the North West Sturgeon Upgrader, to be located on the old site of the abandoned BA Energy Heartland Upgrader. Fortunately, Alberta's economy picked up steam shortly after and everyone stopped talking about building new upgraders in the province.

That is, at least, until now . . .

WHY CNRL BUILT AN UPGRADER AND IMPERIAL DIDN'T

Every oil sands mining operation produces a bitumen product. The old Suncor and Syncrude base plants produce a bitumen product stream with approximately 1% water and 1% solids. This bitumen is then pumped to an adjacent upgrader, where the bitumen is converted to Synthetic Crude Oil (SCO). SCO is then sold on the open market and purchased by refineries, which convert the crude oil to final consumer products, such as gasoline, diesel and jet fuel. It is important to note that these heavy oil upgraders needed to be on-site, or very close to the mine's extraction plant. Since these bitumen streams contain a significant amount of water and fine solids, it could not be feasibly pipelined a long distance due to corrosion/erosion concerns caused by the water and solids.

But construction of the Muskeg River Mine in 2001 marked a step-change in bitumen production technology. In an effort to reduce capital costs, majority owner and operator, Shell Canada, was determined to build its upgrader adjacent to its Scotford refinery near Edmonton. This required Muskeg River to produce a better quality bitumen that could be pumped the 300 km distance from Fort McMurray to Fort Saskatchewan.

Muskeg River was the first oil sands extraction plant to employ paraffinic froth treatment technology (PFT). PFT produces a much better quality bitumen, bringing the water and solids content to virtually zero and reducing the fraction of heavy asphaltenes. This meant that bitumen could now be pumped a long distance, as long as a diluent was used to reduce the viscosity.

CNRL's Horizon Mine began construction shortly after Muskeg River. Horizon uses bitumen production technology adopted from the old Suncor process, again producing a lower quality bitumen with a high water and solids content. The Horizon Mine therefore technically required an on-site upgrader, which was built adjacent to the bitumen extraction plant.

The Kearl Oil Sands Mine was the next facility to be built, and was likely the very first mine that was never intended to be coupled with an upgrader. Much like Muskeg River, Kearl uses PFT technology to produce a high-quality, partially de-asphalted diluted bitumen, which can be sold directly to the open market. Ditto for the upcoming Fort Hills Mine, which cancelled its upgrader in 2008 for much the same rationale. Fort Hills will produce a high quality bitumen product that can be sold directly to any high-conversion refinery with the capacity to process heavy oil.

Kearl will use Imperial Oil’s proprietary paraffinic froth treatment technology (PFT) . . .

The PFT process removes a portion of the heavy end of the barrel (asphaltenes) using less energy than would be required to remove the same heavy ends in a coker at an on-site upgrader, thus reducing greenhouse gas emissions . . . This process eliminates the cost and environmental footprint of an on-site upgrader.

- ExxonMobil Canada

Paraffinic froth treatment marked a step change in technology that rendered bitumen upgrading optional, and no longer mandatory. The economics of building an upgrader now depends on the price difference between bitumen and upgraded crude oil.

WHY WESTERN CANADIAN SELECT IS NOT A RAW BITUMEN PRODUCT

Western Canadian Select (WCS) is a heavy crude oil stream produced by blending bitumen from the oil sands with conventional oil and condensate. Oil sands operators that produce a diluted bitumen final product, such as Kearl and numerous thermal in-situ facilities, are heavily leveraged to WCS prices.

Any facility equipped with an upgrader produces Synthetic Crude Oil (SCO), which sells at prices closer to West Texas Intermediate (WTI). The Suncor, Syncrude and CNRL upgraders in Fort McMurray are the largest producers of SCO in Alberta.

Although we often think of SCO as being "refinery-ready", in fact about 50% of WCS is sold directly to heavy oil refineries, without an intermediate upgrading step. That number is up from 30% in 2006 and is expected to keep rising, as the volume of high quality diluted bitumen produced from the oil sands continues to grow.

The economics of upgrading bitumen to crude oil therefore depends on the price difference between Western Canadian Select and West Texas Intermediate, commonly referred to as the Heavy Oil Discount. If the price difference is wide, it makes economic sense to upgrade to a more value-added product. If the discount is low, then upgrading bitumen to crude oil is completely uneconomical.

THE HEAVY OIL DISCOUNT

Contrary to popular belief, differences in world oil prices are actually a function of infrastructure and market access, not quality or API density.

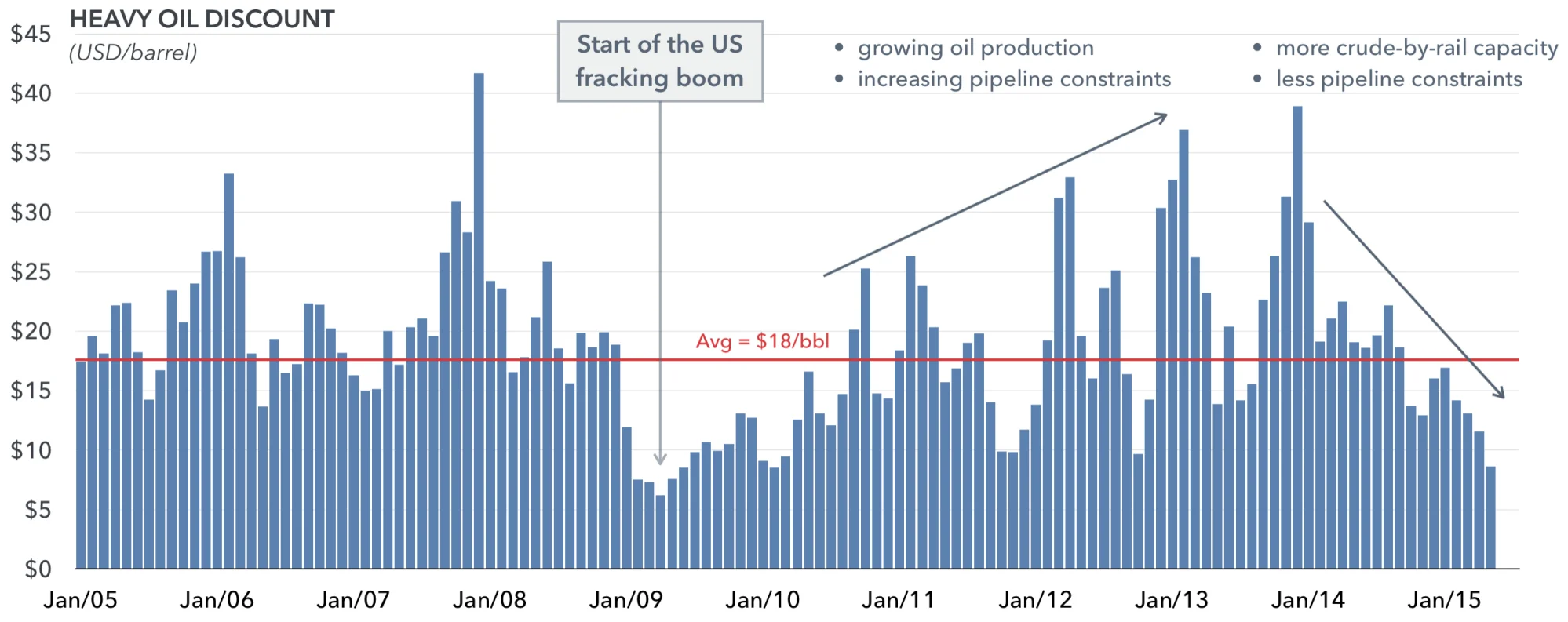

The average heavy oil discount over the past decade is approximately $18 per barrel. After bottoming in 2009, the discount actually began widening. Growing US oil production in North Dakota blocked Canadian heavy oil from US Gulf Coast refineries. The price difference between diluted bitumen and upgraded crude oil grew from less than $10 in 2009 to over $35 per barrel by 2013.

But then differentials began narrowing again. Pipeline construction around the Cushing, Oklahoma oil storage hub eased up the bottlenecks which were blocking heavy oil imports into the US Gulf Coast. Increasing crude-by-rail capacity is helping land-locked Alberta oil reach the east coast of Canada and even international destinations. Most recently, declining oil production in the Bakken shale is helping alleviate space constraints in existing cross-border pipelines. This is all adding up to a narrower differential.

THE COST OF BUILDING AN UPGRADER

The problem in 2007 was not the narrowing heavy oil discount, it was the ever-increasing cost of capital. Building an upgrader is very expensive. Building an upgrader in Alberta is very, very expensive. That means you need a relatively good profit margin in order to write-off the capital within a reasonable amount of time.

THE COST OF RUNNING AN UPGRADER

Excluding the cost of capital, upgrading costs in Alberta are approximately $8 per barrel. Given a present discount of $8.50 per barrel (representing the price difference between upgrader feed and upgrader product), the profit margin on upgrading diluted bitumen to crude oil is very slim.

Although the heavy oil discount varies, anyone contemplating building an upgrader needs to make a bet on the long term differential. Should crude-by-rail continue to gain momentum or any one of the proposed pipelines goes through, expect the heavy oil discount to stay relatively low. Upgrader operating margins are therefore not terribly attractive in the long term.

Since the quality of the diluted bitumen produced in Alberta is now greatly improved, low-margin upgraders are not only too expensive to build, but now also technically no longer required.

And that's why Alberta won't see another upgrader built for a long time, unless the government decides to build it.

ALBERTA AIN'T NO TEXAS

There's actually a very good reason why North America's refining hub is in Louisianna and Texas, and not Alberta. That's because large volumes of refined products can only be transported by ship, not pipelines. Refining crude oil is actually a low margin business, especially when crude oil prices are high. It is not uncommon for refineries to make only a few dollars of profit for every barrel produced. That's why refineries need economy of scale. They're just not profitable to operate on a small scale. To be profitable, refineries need to be big - very big.

Refineries located in land-locked areas produce products for local consumption, such as gasoline, diesel and jet-fuel, which are transported to the end user by truck. The Edmonton refineries supply almost all of Alberta and parts of BC and Saskatchewan, but not too much further. The new North West Upgrader/Refinery will produce diesel for the province and naphtha for the oil sands. The project has been heavily criticized for being a taxpayer subsidized workfare program which may never generate revenue for the province.

Texas has one very important geographic advantage over Alberta - it isn't land locked. Sadly, despite cultural similarities, Alberta ain't no Texas, and likely never will be.

But Texas can also be a great example of what Alberta could be. The Texas state government is very aware of their reliance on the oil industry for jobs, government revenues and prosperity.

Texas has one of the lowest overall taxation rates in the US. The state does not levy corporate or income taxes (yes, you read that right - no income taxes in Texas). Best of all, Texas has done a great job diversifying its economy, siphoning thousands of high-tech jobs from California and offering capital-friendly incentives to any businesses willing to move to the state. Most importantly, the Texas government doesn't threaten to make life more difficult for its oil sector. It proudly accepts its position in the world as an energy superpower and doesn't make apologies for it.

WHY REFINING IN CANADA IS ON THE DECLINE

Big oil companies around the world have been busy shutting down refineries in developed countries such as Canada and Europe. Canada has shutdown no less than 5 refineries across the country in the past 25 years, including the Montreal-East refinery which was once the largest in the country.

US refineries have consolidated and survived much better, primarily because the US consumes huge volumes of refined products. Refineries only make sense where there are a lot of consumers or good port access. Canada now imports a lot of refined products from the US.

As bad as the refining business is in Canada, things are even worse in Europe. Europe has seen countless refineries shutdown in the past decade, and more closing every day. European refineries are plagued by high labour costs, high taxes and high regulation, imposed by socialist governments who have chosen ideology over jobs.

In government policy, as in life, the path to hell is often paved with good intentions.

- Ted Morton, University of Calgary School of Public Policy

So where are all the new refineries being built? Asia and the Middle East. These countries have cheap labour and virtually no environmental regulations. No unions or land owners to negotiate with. No risk of carbon taxes or talk of emission caps. No concerns that oil tankers or pipelines might hurt the birds, fish, water, whales or tourism. And most importantly, no Greenpeace protestors to deal with (if any happen to show up on your doorstep, rest assured they won't be there for very long).

The recently completed SATORP refinery in Jubail, Saudi Arabia is a joint venture between state-owned Saudi Aramco and French energy giant Total. The full convesion complex refinery processes 400,000 bpd of Arabian Heavy Crude, producing refined products for shipment to Europe and Asia. The refinery began operation in 2013 and was reported to be 100% over budget as compared to its initial 2008 cost estimate.

HOW THE NDP CAN CREATE JOBS IN ALBERTA

Oil produced in Alberta is already one of the most expensive on earth. Raising taxes, hiking royalties and imposing more regulations will not help Alberta's energy sector. That will do nothing to support jobs in this province.

Albertans would be much better served by a government that supports the oil extraction industry, both conventional and unconventional. History has clearly shown that when the energy sector prospers, Alberta prosper too.

Give companies that invest billions a more efficient way of depreciating capital. Back-off on royalties and taxes until the capital is written-off. Offer incentives for corporations to hire more local workers instead of looking offshore. Convince other provinces to help us get our oil to tidewater, for the benefit of all Canadians. Help make North America energy independent and stop importing oil from overseas.

Most importantly, be proud of our energy sector, which is already the most transparent and ethical source of oil in the world. Help make Alberta, and by extension Canada, the next great energy superpower.